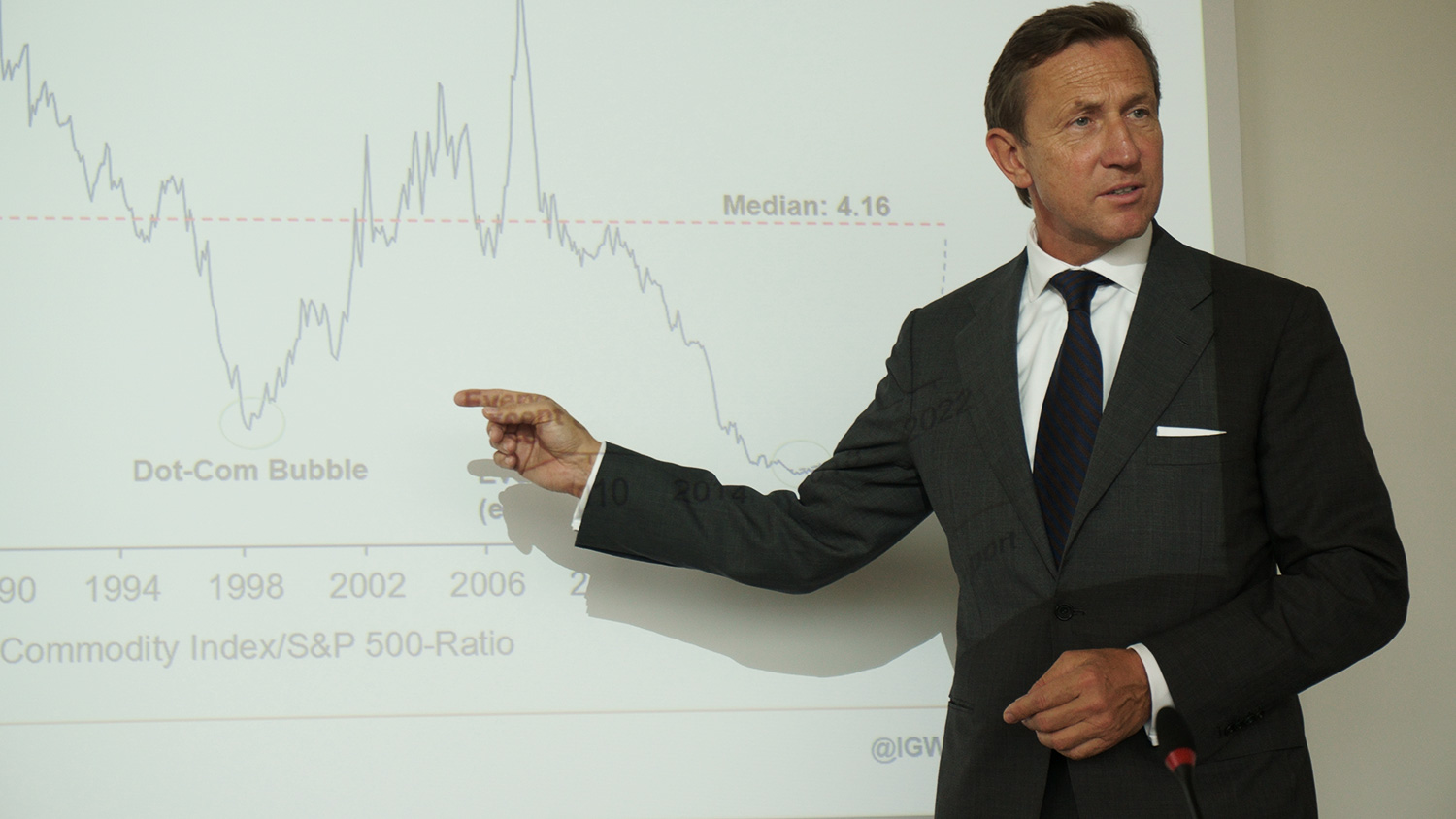

We specialise in asset management and professional portfolio management for private investors and maintain a personal relationship with our clients based on continuity and trust. Based on our many years of experience in the field of investment, we attach great importance to integrating environmental and social factors as well as aspects of good corporate governance. Our clients can rest assured that their capital is invested and managed responsibly.

Cumulative Performance

The performance data for the mandate stems from the client’s custodian bank, Bank Julius Bär AG. The performance data for the benchmark indices derive from finanzen.ch. We draw your attention to the fact that past performance is no guarantee for future performance and that we can’t foresee the future. IPCP = Incrementum Private Client Portfolio

Cumulative Monthly Performance – Incrementum Privat Client Portfolio

Individual needs require individual solutions.

We manage our customers’ portfolios in the same way farmers tend their fields, always with a view to sustainable yields. Our investments focus on participation in companies whose business models generate sustainable positive cash flows and who are prepared to share these with investors in the form of distributions.

Our clients always directly own the assets held through the custodian bank of their choice in Liechtenstein or Switzerland. Thanks to our contacts and long-standing business relationships, and the fact that we do not accept any form of reimbursement such as retrocessions and/or issuing commissions, etc., from banks and/or other financial service providers, our clients benefit from very favourable conditions.